The Future of Payday Loans Online: Predictions and Emerging Trends

- November 25, 2023

- 2 minutes

The domain of finance, with its myriad of nuances and vicissitudes, is continually being reshaped by the forceful waves of technological innovation and changing consumer behavior. One niche in this vast landscape that has experienced substantial transformation is the payday loan industry. Payday loans are short-term, unsecured credit services that are typically repaid by the borrower's next payday. They provide an expedited solution for consumers seeking immediate financial relief, but amid concerns over high-interest rates and predatory lending practices, the industry has been ripe for disruption and rethinking. Today, we explore the emerging trends and forecast the future of online payday loans, drawing insights from various disciplines such as economics, data science, and behavioral finance.

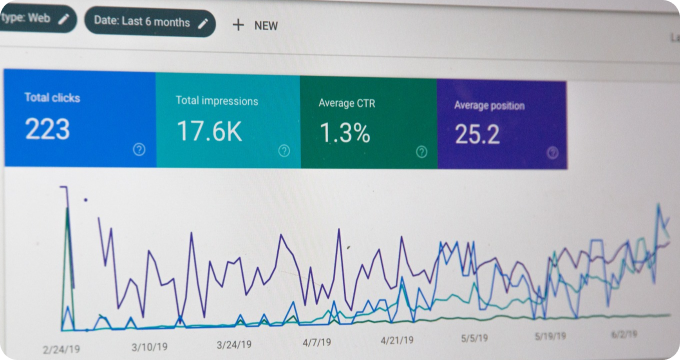

The first trend that has begun to redefine the payday loan landscape is the shift towards online platforms. According to a report by Pew Charitable Trusts, the share of online payday loans has more than doubled, from 21% in 2006 to 48% in 2019. This phenomenon is not surprising given the global digitization wave. It is the manifestation of Schumpeter's concept of 'creative destruction,' where innovation destructs old paradigms and concurrently creates new ones.

The emergence of online payday lending platforms has led to increased accessibility and convenience for consumers. They can apply for loans within a few clicks, without the need to physically visit a branch, thereby saving time and reducing paperwork. However, this digital transformation is not without its set of challenges. With the rise of online platforms, there has been a surge in fraudulent activities and data breaches, raising concerns over data privacy and security. Hence, it is imperative for online payday lenders to invest in robust cybersecurity measures and utilize technologies such as blockchain and machine learning to secure transactions and personal information.

Furthermore, the advent of big data and advanced analytics has opened new avenues for risk assessment in the payday loan industry. Traditional payday lenders largely rely on a borrower's ability to repay, often overlooking his willingness to repay. However, with sophisticated algorithms and machine learning models, lenders can now analyze vast amounts of data, including credit scores, transaction history, and even social media activity, to predict a borrower's behavior more accurately. This approach not only helps in mitigating risks but also enables lenders to tailor their products based on individual consumer profiles, thereby enhancing customer experience and satisfaction.

In the realm of regulatory environment, the future of online payday loans depends significantly on the evolving legal landscape. With the Consumer Financial Protection Bureau (CFPB) revoking its mandatory underwriting requirements in 2020, there has been a shift towards deregulation. However, this move is seen as a double-edged sword. On one hand, it fosters competition and innovation in the industry, yet on the other hand, it may fuel predatory lending practices, leading to a debt trap for vulnerable consumers. Therefore, the challenge lies in striking a delicate balance between innovation and consumer protection.

Looking ahead, one can speculate that the integration of financial technology (fintech) will continue to revolutionize the online payday loan industry. The application of artificial intelligence (AI) and machine learning can provide predictive insights into consumer behavior, enabling personalized loan products. Blockchain technology can bring about transparency and security, mitigating fraud and improving trust. Furthermore, the development of regulatory technologies (regtech) can help lenders navigate the complex regulatory landscape, ensuring compliance while optimizing their operations.

In conclusion, as we stand at the crossroads of technological innovation and changing consumer expectations, the future of online payday loans appears to be a fascinating blend of opportunities and challenges. As companies continue to innovate, leveraging advanced technologies to redefine risk assessment and consumer experience, they must also navigate the murky waters of data security and regulatory compliance. The key to success lies in their ability to adapt, innovate, and most importantly, place the consumer at the heart of their business model.

Learn More

Unearth the secrets of financial flexibility by delving deeper into our enlightening blog posts about payday loans online. For an unbiased, comprehensive view, the reader is encouraged to explore our meticulously compiled rankings of Top Payday Loans Online.

Popular Posts

-

Online Payday Loans Industry Report: Key Findings and Crucial Insights

Online Payday Loans Industry Report: Key Findings and Crucial Insights

-

How to Make a Budget for Managing Payday Loans Online

How to Make a Budget for Managing Payday Loans Online

-

Ask These Questions to a Payday Loans Online Provider to Choose the Right One for You

Ask These Questions to a Payday Loans Online Provider to Choose the Right One for You

-

How to Hire a Reliable Online Payday Loan Provider

How to Hire a Reliable Online Payday Loan Provider

-

8 Things I Wish I'd Known About Online Payday Loans Before Applying for One

8 Things I Wish I'd Known About Online Payday Loans Before Applying for One