8 Things I Wish I'd Known About Online Payday Loans Before Applying for One

- December 02, 2023

- 2 minutes

In the burgeoning digital economy, the financial services industry has seen a drastic shift from traditional methods to online platforms, evidenced by the proliferation of online payday loans. These short-term, high-interest loans, designed to tide borrowers over until their next paycheck, have become increasingly popular due to their convenience and immediacy. Reflecting on my own experience, there are eight key considerations I wish I'd been aware of before embarking on this journey.

Firstly, the importance of comprehending the annual percentage rate (APR) cannot be overstated. The APR is a measure of the cost of credit, expressed as a yearly rate. It is relevant because it allows consumers to compare loan offers on equal terms. Payday loans are notorious for their extraordinarily high APRs, often reaching triple digits. If you are not careful, you could end up paying more in interest than the original loan amount.

Secondly, understanding the differentiation of state regulations is critical. Various states in the U.S. have disparate legislation governing payday loans, with some prohibiting them altogether. This can impact the maximum loan amount, loan term, fees, APR, and even the number of loans you can have at once. To navigate this complex landscape, a thorough investigation of your specific state's regulations is indispensable.

The third point regards the validation of lender legitimacy. A common pitfall of the digital age is the increase in fraudulent activities. The online payday loan landscape is not immune, making it imperative to verify the authenticity of the lender. Look for accreditation from bodies such as the Better Business Bureau or online reviews from previous borrowers.

Next, it's crucial to familiarise oneself with the loan term. Payday loans are typically offered for a period of 2 to 4 weeks, aligning with the borrower's pay cycle. Failure to repay the loan within this time can lead to rollover fees, adding to the overall debt burden and potentially creating a debt trap.

The fifth point pertains to the loan's purpose - it should be viewed as a short-term solution to an unexpected financial shortfall, not a long-term fix for chronic financial problems. This is a common misperception that leads many into a cycle of debt.

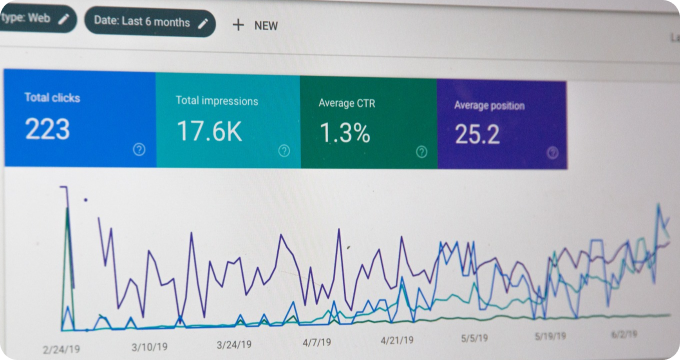

The sixth point relates to the technological aspect of online payday loans. Most online lending platforms utilize advanced algorithms for credit scoring, which differ from traditional models. These algorithms can consider unconventional variables such as social media presence or online shopping habits. Therefore, a good credit score may not necessarily translate to a favourable rate, or even loan approval.

The seventh point I wish I'd known regards the implications for your credit score. While some lenders may not require a credit check, many do report to the three major credit bureaus. Failure to repay on time can therefore negatively impact your credit score.

Finally, the eighth aspect involves knowing your rights. For instance, the Fair Debt Collection Practices Act prohibits lenders from using abusive or deceptive tactics to collect a debt. If you find yourself in a situation where you cannot repay the loan, understanding your rights can protect you from unscrupulous tactics.

In retrospect, awareness of these eight points would have significantly enhanced my understanding and approach to online payday loans. Informed decisions can prevent one from falling into a debt trap and ensure that these loans serve their intended purpose - as a temporary solution to financial emergencies. As with any form of credit, prudence, due diligence, and responsible borrowing are key.

Learn More

Unleash the power of financial freedom and discover the world of payday loans online by diving deeper into our enlightening blog posts. For an unbiased, comprehensive view, the reader is encouraged to explore our meticulously compiled rankings of Top Payday Loans Online.

Popular Posts

-

Online Payday Loans Industry Report: Key Findings and Crucial Insights

Online Payday Loans Industry Report: Key Findings and Crucial Insights

-

How to Make a Budget for Managing Payday Loans Online

How to Make a Budget for Managing Payday Loans Online

-

Ask These Questions to a Payday Loans Online Provider to Choose the Right One for You

Ask These Questions to a Payday Loans Online Provider to Choose the Right One for You

-

How to Hire a Reliable Online Payday Loan Provider

How to Hire a Reliable Online Payday Loan Provider

-

8 Things I Wish I'd Known About Online Payday Loans Before Applying for One

8 Things I Wish I'd Known About Online Payday Loans Before Applying for One