How to Make a Budget for Managing Payday Loans Online

- November 18, 2023

- 2 minutes

Radiating an aura of fiscal responsibility and financial acumen, payday loans online have surfaced as a contemporary solution for those caught amidst financial exigencies. However, it is of paramount importance to be equipped with an effective budgeting strategy to manage these loans efficiently. This article aims to elucidate a step-by-step guide to crafting a budget for managing payday loans online, delving into the intricacies of financial planning, relevant economic principles, and the role of digital technologies.

First, let's dissect the concept of payday loans online. They are typically short-term, high-cost loans, designed to tide over immediate cash needs until the next payday - hence the name. The online part denotes the digital platform through which these loans are availed, eliminating the need for physical paperwork and enabling quick disbursement.

Crucial to the discourse is understanding the economic principle of time value of money (TVM), which essentially states that a dollar today is worth more than a dollar tomorrow. TVM explains the inherent costs associated with payday loans online. It's not just about repaying the principal, but also the interest and fees, which are the lender's way of charging for the 'time value' of the money lent.

To manage payday loans effectively, it is essential to devise a practical budget. A budget is a financial plan that outlines your income and expenses, enabling you to allocate resources efficiently and avoid overspending. Here’s a step-by-step approach to create a budget tailored to manage payday loans online:

- Identify your income: Ascertain your total monthly income from all sources.

- Itemise your expenses: Categorise your expenses into fixed (rent, utilities, etc.) and variable (eating out, entertainment, etc.).

- Prioritize debt repayment: Allocate a portion of your income to the repayment of the payday loan. This should be treated as a non-negotiable expense.

- Establish an emergency fund: Consider setting aside a small percentage of your income as a buffer for future financial emergencies, preventing the need for further loans.

- Monitor and adjust: Keep track of your expenses and make adjustments as needed. This is not a static document but a dynamic one that needs to evolve with time.

The aforementioned steps are reminiscent of the classic economic theory of consumer behaviour, which suggests that an individual aims to maximise utility given a budget constraint. In this context, the payday loan repayment becomes a part of the budget constraint, compelling individuals to make optimal trade-offs between different spending categories to fulfil this obligation while attempting to maintain their standard of living.

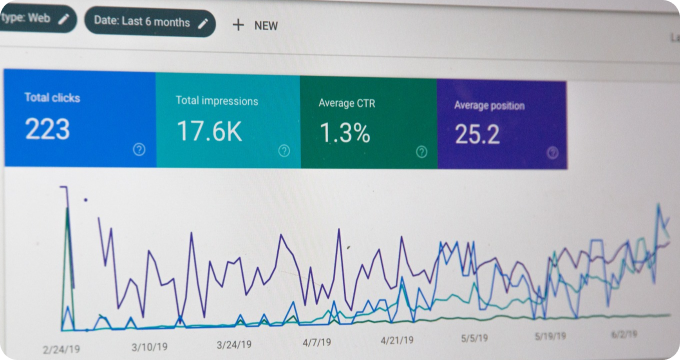

While budgeting can be done manually or with traditional spreadsheets, the advent of digital technologies has ushered in a myriad of innovative tools for financial management. Fintech apps often come with features like automatic expense tracking, graphical representations of spending, and timely alerts, which can significantly simplify the budgeting process. However, the choice between traditional and digital methods hinges on personal preferences, comfort with technology, and the complexity of one's financial situation.

In conclusion, managing payday loans online optimally requires a marriage of sound financial planning, understanding of relevant economic principles, and effective use of technology. A well-structured budget serves as a financial compass, guiding individuals towards timely loan repayment and overall financial stability, thereby reinforcing the famous Benjamin Franklin adage, "Beware of little expenses. A small leak will sink a great ship."

As we navigate the murky waters of personal finance, let's not forget that while payday loans online provide a lifeline in times of financial turbulence, they should not be viewed as a long-term solution. Financial prudence and a commitment to saving and investing for the future are the cornerstones of economic security and prosperity.

Remember, the ultimate aim should not just be to survive, but to thrive financially. Budgeting is one of the first and most critical steps in this journey.

Learn More

Unearth the secrets of financial flexibility and discover how payday loans online can be your lifeline in times of need by delving deeper into our enlightening blog posts. They are encouraged to explore our impartial and comprehensive rankings of Top Payday Loans Online to make an informed decision.

Popular Posts

-

Online Payday Loans Industry Report: Key Findings and Crucial Insights

Online Payday Loans Industry Report: Key Findings and Crucial Insights

-

How to Make a Budget for Managing Payday Loans Online

How to Make a Budget for Managing Payday Loans Online

-

Ask These Questions to a Payday Loans Online Provider to Choose the Right One for You

Ask These Questions to a Payday Loans Online Provider to Choose the Right One for You

-

How to Hire a Reliable Online Payday Loan Provider

How to Hire a Reliable Online Payday Loan Provider

-

8 Things I Wish I'd Known About Online Payday Loans Before Applying for One

8 Things I Wish I'd Known About Online Payday Loans Before Applying for One